Consumer Protection

Beware of Tick Bites This Summer

Usually we post blog entries about preventing accidents and safety issues. But here is something that is a serious matter of public health, and we want you to protect yourself!

The incidence of tick-borne illnesses is rising sharply in Massachusetts, in New England, and throughout the country. If not diagnosed and treated promptly, infections can lead to disabling injuries, brain damage, organ failure, and even death. Prompt diagnosis is key, but even more important: Avoiding tick bites.

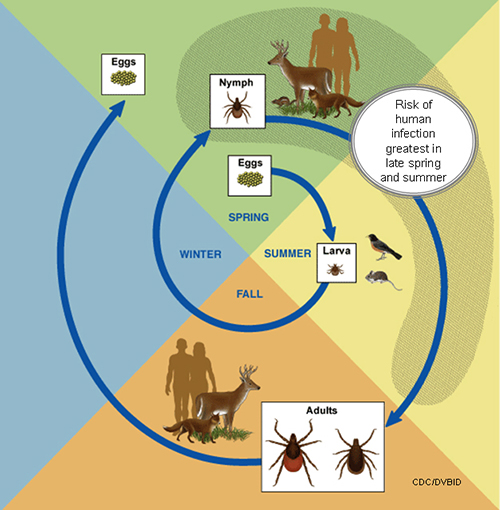

Understanding tick behavior is the first line of defense. Ticks are active throughout the warm weather months, but even a warm day in February can bring them out. They are most likely to transmit disease in the spring and early summer when they are in their nymph stage (when they are young and smaller). Ticks lurk in leaf litter, tall grass, and on shrubbery, just waiting to hitch a ride on your skin and clothing. Then they wander around until they find a place to bite. They will attach themselves and suck your blood until they are fully engorged. And if they are carrying one of the many bacteria that can make you ill, it will be transmitted during this time.

There are several ways to protect yourself, including wearing insect repellent or clothing treated with permethrin, an effective insecticide that is safe to use. Prevent ticks from getting on your skin by wearing long pants and long shirts, and stay tucked in. Check for ticks after you have been outside. More on this below.

Tick Diseases are on the Rise

It’s unfortunate that we have to think about protecting against ticks. But it’s also necessary. Each summer brings more and more reports of tick-borne illnesses in Massachusetts and across the U.S. According to the Centers for Disease Control and Prevention (CDC), 59,000 tick-borne diseases were reported during 2017 alone, more than 10,000 cases over 2016. More than 42,000 cases were Lyme Disease. According to the CDC, the number of U.S. counties considered at high-risk for Lyme Disease increased by more than 300 percent between 1992 and 2012.

Lyme Disease and Other Tick Diseases in Massachusetts

In Massachusetts, several types of ticks are known to spread infection. These include the black-legged tick, most often known as the deer tick, the dog tick and the lone star tick (Source: Mass.gov).

Black-legged ticks can transmit Lyme disease, anaplasmosis (HGA), babesiosis and other tick-borne illnesses. These are all very serious illnesses which can leave an otherwise healthy person with chronic pain, an irregular heart rhythm and other symptoms. Some of these illnesses can even lead to death.

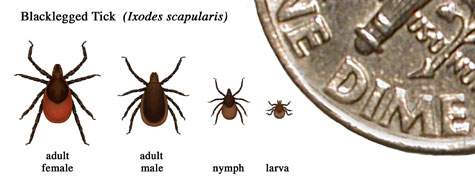

While we associate ticks with warm weather, black-legged ticks can bite year-round in Massachusetts. The young ticks (called nymphs) are most active during May, June and July. Adult ticks become more active during the spring and fall, but can bite anytime the temperature is above freezing. It’s easy to mistake nymphs for other insects because they are small, about the size of a poppy seed.

Black-legged tick by size. Graphic courtesy: CDC.

When black-legged ticks infect someone with Lyme Disease, the person may suffer fever, chills, headache, fatigue, muscles and joint pain and swollen lymph nodes. About 4 out of 5 people will break out in a rash which is often a bullseye in appearance. In some cases, more serious symptoms emerge, including arthritis, heart palpitations, joint pain, nerve pain and problems with short-term memory.

Adult dog ticks are roughly the size of a watermelon seed and can spread Rocky Mountain spotted fever, which can lead to fever, headache, vomiting and rash in the first 3 to 5 days. Rocky Mountain spotted fever can result in death if left untreated.

Though it’s relatively rare in Massachusetts, dog ticks can also pass on certain types of tularemia, which results in skin sores and swollen glands. As for lone star ticks, it is important to guard against them because they can also cause rash, tularemia and southern tick-associated rash illness (STARI). But lone star ticks are not a significant source of human illness in Massachusetts at this time, according to the state website.

The the greatest risk for tick bites is in late spring and summer. Graphic courtesy: CDC.

How to Protect Your Family

The best ways to protect yourself from tick bites and tick-borne illnesses is to be aware of potential exposure in the deep woods and tall grass, wear the right insect repellent and continuously check your skin throughout the day and at the end of the day.

Insect Repellent

- Use EPA-registered insect repellents which contain DEET, picaridin, IR3535, oil of lemon eucalyptus (OLE), para-menthane-diol, or 2-undecanone. Use these products as instructed.

- Use insect repellent products with permethrin to treat clothing, socks, boots and tents. You can also look for products which have been pre-treated with permethrin. Follow the instructions for application carefully. Permethrin is applied to clothing, then allowed to fully dry. It is not meant to be sprayed on just before use. Treated clothing is effective for several washings. The good news is that the ticks that do climb on your treated clothing will die.

- Take extra caution when shopping for insect repellent products for children and those with medical conditions. Again, read product instructions.

- Children younger than 2 months old should never use products containing DEET. The CDC recommends putting babies in strollers covered in mosquito netting.

Understand How Ticks Infect

Ticks can contract bloodborne infections such as Lyme Disease by feeding on infected animals, especially white-footed mice. Then they carry these infections into your backyard and wait for their next prey. This could be you, your children, your guests or your pets.

Unlike other insects, ticks cannot fly or jump. They latch onto tall grass with their back legs, ready to climb on you when you pass by. This is called “questing.”

A black-legged tick can attach to your skin and feed on your blood for several days. Once the tick is done feeding, it will remove itself and find another person or animal to bite.

Avoid tall grass and shrubs, as well as the outer edge of your backyard. Ticks often camp out along well-traveled paths on your property, including near stony landscaping. Wherever you walk or hike this summer, walk in the center of the path.

The sooner you see a tick on your body and remove it, the better. According to the CDC, people who remove ticks within 24 hours can greatly reduce their risk of getting Lyme Disease.

Pets

Cats and dogs can bring ticks into your home. Talk to your veterinarian about how to protect your pets during the summer months. There is no evidence showing your pet can pass Lyme Disease onto you, but if your pet is bitten, they could suffer symptoms and you could be bitten as well. Since ticks can be carried into your home, be aware of exposure in your house.

Dressing Safely for the Outdoors

- Dress appropriately. Wear long-sleeves and pants when working in wooded areas. Tuck shirts into pants and pants into boots.

- Consider wearing white and other light colors if it helps you check for ticks easier.

- Another tip is you can use a lint roller on your clothes and shoes before you come inside.

- Take a shower as soon as you come inside. Rinsing ticks off before they bite is very effective.

- Toss your clothes in the dryer on high heat for 10 minutes to kill ticks.

Checking for Ticks and Extra Precautions

- Conduct a full-body tick check once or more daily. Use a hand-held or full-length mirror so you can check your back and other areas of your body. Check along your hairline, inside and behind your ears, the back of your neck, all over your arms and armpits, legs, behind your knees and even between your toes.

- Parents should check children thoroughly for ticks every few hours. Teach children to regularly check their own arms and legs as they play.

- Look closely and remember, ticks are different sizes.

- If you see a tick, carefully remove it from your skin with a pair of tweezers. Pull it out with a steady hand so you remove it all at once. Then clean your skin with rubbing alcohol or soap and water.

- You should dispose of a tick just as you would anything else that’s poisonous. Place it in a sealed plastic bag or flush it down the toilet. If you are concerned that the tick was on you long enough to bite, you can seal the tick in a plastic bag for later testing.

Visit Your Physician and Get Prompt Treatment

Massachusetts residents should visit their doctor if they suffer a tick bite.

There is a high risk for Lyme Disease in Massachusetts and other New England states. If you, your child or another family member were bitten by a tick, contact your physician immediately. Even if you don’t believe you are experiencing any symptoms, this is an important call to make. Your physician is knowledgeable about your medical background and the medications you are on and is in the best position to help you understand if you may need to take an antibiotic. If exposure to Lyme disease is considered a probability, your physician will likely prescribe a single dose of doxycycline as a prophylactic measure. It is very important to monitor yourself for symptoms of potential infection, including rash, headache, muscle or joint ache, or fever. If you are suspicious, seek prompt treatment to avoid more serious complications.

Use Reasonable Care and Good Sense

Don’t let the fear of ticks or other insects ruin a perfectly good summer. Use reasonable care and good sense, and you and your family should enjoy great outdoor fun.

Protect Yourself From ATM Skimming

Take the right steps to protect yourself from ATM skimming. Many Massachusetts consumers have been targeted.

You insert your ATM card and out comes cash for the week. Simple, right? Next time, pay closer attention. Many Massachusetts consumers are being scammed – or skimmed – for their financial information, at a tremendous price.

ATMs – automated teller machines – are a convenient way to get cash or make deposits. Unlike banks, they are always open and accessible.

But they are vulnerable to ATM skimming, when thieves install hidden electronic skimming devices on an ATM to record a consumer’s financial information. Massachusetts has seen several recent cases.

Just this week, Cambridge Police issued an alert, seeking a man who fraudulently ran up $800 on a Cambridge woman’s ATM card. Police say he may have skimmed her financial information at an ATM in Boston. ATM skimming rarely claims just one victim, though. In June, the Lowell Sun reported on two men who pled guilty after ringing up over $100,000 on 100 credit card numbers they skimmed in the Boston area. Other stories have also been reported in Framingham, Burlington and on the South Shore

The problem is skimming devices are often small and look like part of an ATM, so consumers may not notice them, even if they are looking.

Use caution at the ATM machine. We suggest the following tips to help you protect your financial information:

- Examine the card slot before inserting your card. Look for anything loose, crooked, damaged or scratched. If you observe anything suspicious, do not swipe your card. We suggest you read this article, “How to Spot and Avoid Credit Card Skimmers,” by PC Magazine.

- Thieves also need your PIN code. They often record your information through hidden cameras. When entering your PIN, cover the keypad with your other hand to prevent your PIN from being recorded.

- Walk away from an ATM if you notice someone watching you or you sense something is wrong with the machine.

- Avoid ATM machines with minimal supervision. For instance, try not to use stand-alone ATM machines in convenience stores, bars or parking lots.

- Also beware of skimming devices when paying at gas stations.

- If an ATM does not return your card when a transaction is over, report the incident immediately to your financial institution.

- Never give out your bank account number or the PIN for your ATM card. If someone calls you and asks for your information, hang up and report the call to your local police department.

- Monitor your account for unauthorized transactions and report them to your financial institution immediately. Most banks offer online access, which allows you to check your statements easily.

- Set a daily cash withdrawal limit. Ask your bank and credit card company to notify you of transactions—these can be sent right to your cell phone.

- Check in on senior citizens in your family or neighbors. Tell them you are concerned about ATM skimming. Remind them to check their bank accounts, and also, to never give their financial information out to callers over the telephone.

- The most important step? Contact police and your bank if you suspect anything suspicious. The sooner police and your financial institution can start investigating, the better for everyone using the ATM machine.

If you do find yourself a victim, remember you have rights. Under Massachusetts law, consumers are only liable for up to $50 if they are the victim of credit card or debit card fraud. But you must report the fraud immediately to avoid any financial losses. Read this article to learn more.

What Target Shoppers Can Do Following Massive Data Breach

If you are a Target shopper, you are likely watching your debit or credit card account closely these days. This is a good start, but there are other important steps you can also take following the retailer’s massive data breach, now estimated to have impacted at least 70 million customers. The data breach occurred at Target’s retail stores between Nov. 27 and Dec. 15. Hackers stole customer names, credit and debit card numbers, the card’s expiration date and CVV, the three-digit security code. Online holiday shoppers were not involved.

If you are a Target shopper, you are likely watching your debit or credit card account closely these days. This is a good start, but there are other important steps you can also take following the retailer’s massive data breach, now estimated to have impacted at least 70 million customers. The data breach occurred at Target’s retail stores between Nov. 27 and Dec. 15. Hackers stole customer names, credit and debit card numbers, the card’s expiration date and CVV, the three-digit security code. Online holiday shoppers were not involved.

What to do if you were impacted:

Monitor your accounts. Be vigilant and monitor all your financial accounts regularly over the next 12 to 24 months. If you notice any irregular activity, notify the credit card issuer or your bank immediately.

Make contact now. Ask your bank or credit card company’s fraud department to also closely monitor your account.

New card and account number. Ask your bank or credit card company about changing your pin number and whether you should have a new card issued.

Contact Target. The company says customers have zero liability for any fraud resulting from this data breach and are offering free credit monitoring and identity theft protection for impacted customers. Learn more.

Obtain your credit report. You are entitled to one free credit card report each year from one of the three major credit bureaus, Equifax, Experian or TransUnion.

One-call fraud report. Call any of the three major credit bureaus and place a one-call fraud alert on your credit report. This requires creditors to contact you before opening any new accounts or increasing your credit card limits. The fraud alert will stay on your account for at least 90 days.

Extended fraud alert. If your credit report reveals suspicious activity, you can file a report with your local police department and have an extended fraud alert placed on your credit report. This will provide additional protection for seven years.

Security freeze. You also have the right to place a security freeze on your consumer credit report. This stops consumer-reporting agencies from releasing any information in your credit report without your express authorization.

Beyond the financial risk, identity theft can create many hours of work for victims trying to straighten out accounts and identify where breaches occurred. Read the resources below to learn how to protect yourself.

Related:

Identity Theft, Federal Trade Commission.

Lost or Stolen Credit, ATM, and Debit Cards, Federal Trade Commission.

Protecting Against Credit Card Fraud, Federal Trade Commission.

Read More

Watch Out for This Recalled Children’s Toy

The Consumer Product Safety Commission (CPSC) announced several product recalls last week, including one for a dangerous child’s toy which can cause choking and which has been involved in a death. Also recalled were a high-end bicycle with defective brakes and a flat screen television which can overheat and catch on fire.

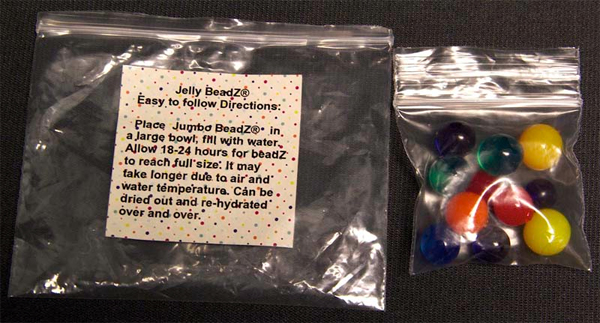

Doodlebutt Recalls Jelly BeadZ Jumbo BeadZ and Magic Growing Fruity Fun Toys Due to Serious Ingestion Hazard

About 1,500 of these small water-absorbing toys have been recalled by the importer, Doodlebutt of Lehigh Acres, Florida. The Jumbo BeadZ toys are marble-sized water absorbing balls and the Magic Growing Fruity Fun toys are water-absorbing polymer shapes, such as apples, bananas, butterflies and cherries.

The CPSC is aware of one incident in which an 8-month-old girl ingested the ball and it had to be surgically removed and two cases outside the United States, including one resulting in death.

The CPSC warns children can mistake the toys for candy and when swallowed, they can expand inside a child’s body. The toys can absorb 300 to 500 times their weight and grow up to eight times their original size. Children can suffer vomiting, dehydration and life-threatening injuries. Another problem is similar toys have not shown up on x-rays.

The toys were sold through Amazon.com from February 2012 to September 2013 for about $9. Consumers are advised to take the products away from children immediately and stop using the product. They can contact Doodblebutt for a full refund. Read the CPSC recall notice.

Eight Retailers Recall 32″ Coby Flat Screen Televisions Due to Fire and Burn Hazards

Eight retailers have recalled the 32″ Coby Flat Screen Television due to fire and burn hazards. These retailers have initiated the recall because Coby USA, the product importer and distributor, has gone out of business.

The CPSC has received reports of six incidents involving televisions overheating, smoking or catching on fire. No injuries were reported, but there was some property damage. In two cases, televisions caught on fire and one also scorched a wall.

Consumers are told to turn off and unplug the televisions and contact their retailer. Retailers may offer different remedies, which may include a refund, store credit, gift card or replacement TV. About 8,900 of the televisions were sold through:

Sears/Kmart

Toys R Us

ABC Warehouse

Fry’s Electronics

h.h. Gregg

Nebraska Furniture Mart

P.C. Richard & Son.

Online retailers

BestBuy.com dealtree.com

techliquidators.com

bestbuy.dtdeals.com

The televisions were sold nationwide from August 2011 through November 2013 for between $170 and $260.

Read the CPSC recall notice for the model numbers involved in this recall.

Trek Recalls Madone Bicycles Due to Crash Hazard; Front Brake Can Fail

Trek has recalled several models of its year 2013 Madone bicycles after five reports of loose front brake attachment bolts. No injuries have been reported, but consumers are advised to stop using the bicycle and take it to a Trek dealer for a free replacement front brake system. The bicycles were sold nationwide from July 2012 through this month for between $3,400 and $6,300 and for custom models, up to $15,000. About 6,300 bicycles are involved in this recall. Read the CPSC recall notice.

Other Recalls:

Shaws Industries Recalls Carpet Due to Fire Hazard; Sold Exclusively at Lowe’s Stores

Hobby Lobby Stores Recalls Accent Chairs Due to Risk Injury

Read More

Household Safety: Check Old Appliances Before Winter

Now, as we head into winter, is a good time to test your home’s smoke alarms, check your appliances and inspect your electrical outlets and cords.

Now, as we head into winter, is a good time to test your home’s smoke alarms, check your appliances and inspect your electrical outlets and cords.

First, a good resource is the Consumer Product Safety Commission (CPSC) website, where you can search for recall news about products you may own. Recently, there have been several recalls involving products posing serious fire hazards.

One example is Schneider Electric IT Corp. recalled 15 million APC Surge Arrest surge protectors in early October. This followed 700 reports of property damage, including $916,000 in fire damage to a home and $750,000 to a medical facility. Another 13 reports were injuries, including smoke inhalation and contact burns. Another example is Gree Electric Dehumidifiers, which recalled 2.2 million dehumidifiers in the U.S. last month, after its products caused 46 fires and $2.15 million in property damage.

You can review the CPSC website to make sure you have no recalled products in your home. You can also take a look around your home for faulty cords or products.

Preventing Home Fires in the Winter

During a typical year, there are over 26,000 home electrical fires in this country, according to the U.S. Fire Administration. December and January see the most electrical fires. We share a few tips for preventing these fires:

1) Check your smoke alarms before the season.

2) Regularly check your electrical appliances and wiring. Replace any old or damaged cords; do not try to repair them.

3) Replace any appliance you feel may not work properly. If you do not want to replace it, call a repair service or visit the store where you purchased the product. Check electric space heaters every year as a rule.

4) Buy appliances which have the label of a recognized testing laboratory, such as UL.

5) Avoid using extension cords.

6) Use only surge protectors or power strips that have internal overload protection and have been tested by a national laboratory.

7) Keep clothes and flammables at least three feet away from all portable electric space heaters.

8) Use light bulbs that match recommended wattages for lamps.

9) Bring in an electrician if you are experiencing flickering lights or other problems.

Related:

Electrical Home Fire Safety, U.S. Fire Administration

Schneider Electric Recalls APC Surge Protectors Due to Fire Hazard, Consumer Product Safety Commission.

Read More

Dangerous Magnet Toys Recalled by Major Retailers

The Consumer Product Safety Commission (CPSC) has moved a step closer to taking two dangerous magnet toys out of the hands of children.

On April 12, six retailers voluntarily recalled Buckyballs and Buckycubes. The stores included Barnes & Noble, Brookstone, some Hallmark stores, Marbles the Brain Store and Think Geek.

Maxfield & Oberton Holdings of New York City, the importer and distributor, refused to issue a recall last year, prompting the CPSC to file a lawsuit against the company in July to stop sales. The rare legal action – one of just four taken by the CPSC in the past 11 years – resulted in the company discontinuing its products in October. It stopped doing business in December.

The product was manufactured by Ningo Prosperous Imp. Exp. Co. Ltd. of Ningbo City in China.

Buckyballs and Buckycubes vary in size and color, but they are essentially a ball or cube of small powerful magnets. They were sold in containers of 10 to 216 magnets that can become loose. The first of the two products was introduced in the U.S. in March 2009. Since then, over three million sets of magnets have been sold in U.S. retail stores and online.

Maxfield & Oberton initially marketed Buckyballs to children, calling it “an amazing toy.” It later rebranded the magnet toys as an adult desk toy and stress reliever.

But while the magnets were being marketed to adults, the CPSC was still receiving reports that children were swallowing them. It has received 54 reports of injuries, all but one requiring medical treatment.

CPSC Complaint

The CPSC’s July 25, 2012 complaint alleged that the magnet products had defective labeling and warnings, defective design, and posed a substantial product hazard.

The CPSC began working with the company on labeling three years ago, when the magnets were labeled for use by children “Ages 13+.” The agency said the magnets should have been marketed for age 14 and up.

Maxfield & Oberton changed the labeling and agreed to a voluntary recall of 175,000 magnet toys, but the CPSC said the injuries continued. In its complaint, it states, “…labeling and warning labels cannot guard against the foreseeable misuse of the product and prevent the substantial risk of injury to children.”

Company officials did not agree with the CPSC’s action. In October, they posted a statement on their website that read in part: “We’re sad to say that Balls & Cubes have a one-way ticket to the Land-of-Awesome-Stuff-You-Should-Have-Bought-When-You-Had-the-Chance.”

Dangerous Toy

Over the past few years, the CPSC set up a Magnets Information Center on its website to educate the public about the danger of swallowing magnets.

The risk is that if a child ingests more than one of the powerful magnets, they can become attracted to each other while in the intestines, pinching tissue and damaging the intestinal walls. This can result in a wide range of symptoms, including vomiting, abdominal pain, infection and death. Surgery is often required and becomes more complicated because the magnets can stick to the metal surgical tools.

And in some cases children ingested more than one or two. CBS News reported the case of a 3-year-old Oregon girl who swallowed 37 Buckyballs. The CPSC complaint details cases of other young children who have swallowed numerous magnets.

Related:

CPSC administrative complaint

Recall information for consumers

Massachusetts Law on Waivers and Releases

The proposition is all too familiar: You or your children want to participate in an activity. It could be at school, for a sporting event, in connection with a walk-a-thon or bike-a-thon, or in some other activity where there is a risk involved. Maybe the event is really risky, such as learning to drive a race car, or learning how to rock climb. Part of the price of admission to all of these activities is your signature at the bottom of a release or waiver of liability.

The proposition is all too familiar: You or your children want to participate in an activity. It could be at school, for a sporting event, in connection with a walk-a-thon or bike-a-thon, or in some other activity where there is a risk involved. Maybe the event is really risky, such as learning to drive a race car, or learning how to rock climb. Part of the price of admission to all of these activities is your signature at the bottom of a release or waiver of liability.

The language of the typical release is usually very broad and even includes the requirement that you indemnify the organization against related claims. You will be binding not only yourself, but your family, and in the case of a wrongful death, your heirs.

Are they legal? Most of the time yes, though there are some important exceptions which will be discussed below.

The Massachusetts courts generally uphold the validity of releases and waivers that are entered into knowingly. This includes pre-accident releases as well as releases in connection with settlements. Our courts have repeatedly affirmed just how broadly Massachusetts law favors the enforcement of releases.

Simply put, a defendant ordinarily may “validly exempt itself from liability which it might subsequently incur as a result of its own negligence.” Lee v. Allied Sports Assocs., 349 Mass. 544 , 550 (1965) (car racetrack accident).

In the more recent case of Sharon v. City of Newton, 437 Mass. 99 (2002), the court enforced a release signed by a father on behalf of his daughter as a condition of her participation in cheerleading in her high school. After she was injured, the family brought suit for the school’s negligence. The release was raised as a defense, and the court strongly affirmed the enforceability of the release, citing a host of public policy arguments.

The requirements for a binding release include clear and conspicuous language, proper naming of the party, the signature of the party, and valid contractual “consideration.” Consideration, meaning something of value that is exchanged, is satisfied by the participation in the activity.

Some particularly disturbing releases seek to include third parties who may be related to the activity named in the release. For example, your school child may wish to participate in after-school volunteer activities, and the release required to participate may include all the companies participating in the program. Now assume something horrible–the contracting company had failed to screen its employees, and a dangerous criminal was employed and caused your child harm. The negligent hiring would likely be within the scope of the release.

There are some exceptions to enforceability of releases. There are certain statutory exceptions that apply. One exception (and it is one that is frequently violated) is a release of liability to join a gym or health club. G.L. c. 93, Section 80 makes such language unenforceable and, in fact, a violation of G.L. c. 93A, the Consumer Protection Act. If you are injured in a health club due to equipment failure, a defect on the premises, or the negligence of a staff person, you will be able to bring your claim. Here is a related blog on health club waivers and releases.

Although a party may contract against liability for harm caused by its own negligence, it may not do so with respect to harm caused by its gross negligence. Zavras v. Capeway Rovers Motorcycle Club, Inc., 44 Mass. App. Ct. 17 (1997). See also Gillespie v. Papale, 541 F. Supp. 1042, 1046 (D. Mass. 1982).

A party may not contract against liability for harm caused by violation of a statutory duty. Zavras v. Capeway Rovers Motorcycle Club, Inc., 44 Mass. App. Ct. 17, 19 (1997), citing Gillespie v. Papale, 541 F. Supp. 1042, 1046 (D. Mass. 1982).

A release may be avoided, in part, if it is the result of a “mutual mistake.” In the exceptionally rare case of Leblanc v. Friedman, 53 Mass. App. Ct. 697 (2002), a settlement release was not a complete bar to a subsequent claim by the plaintiff. The plaintiff settled a medical malpractice case arising from an instrument left in her body, and although the release was worded broadly, the court found there was a question of fact whether it was meant to include another injury not described in the release itself.

What Should You Do?

Entering into a release is an important contractual event. You should consider whether the reward overrides the risk. Some pre-enrollment due diligence is a good idea–ask about the staff involved, inspect the premises, get some references. If you are not willing to release all of your claims, try crossing out the offending language or simply not signing the release. However, most organizations are wise enough to recognize and disallow both of those techniques.

It would be appropriate for the Massachusetts legislature to consider revising the law of pre-accident releases. Sadly, that day does not look likely to come any time soon.

Contact our Boston attorneys today

The lawyers at the Boston firm of Breakstone, White & Gluck represent clients who have suffered personal injury as a result of the negligence of others. We have had experience identifying unenforceable releases which has allowed our clients to proceed with their claims for compensation. For more information and a free consultation, contact us today at 800-379-1244 or 617-723-7676 or use our contact form.

What Massachusetts Consumers Need to Know about Health Club Contracts

If you exercise at a health club, you may not be aware that Massachusetts law protects you in many ways from unlawful club contracts. But many local health clubs – yours may be included – are regularly violating the law.

Health clubs are serving larger numbers than in the past. Over 50.2 million Americans now hold gym memberships, a 10 percent increase over the past three years, according to the International Health, Racquet & Sportsclub Association.

The industry has been known to make it challenging for members to cancel or put their memberships on hold. Sometimes, after you sign the cancellation agreement, they require you to pay until month’s end, then another full “last month.” In addition to monthly membership fees, many are also now adding new fees for “annual” memberships and equipment maintenance. Some are even charging cancellation fees up to $200. This is still legal in Massachusetts, though not at all consumer friendly.

But did you notice the fees clearly posted the last time you visited your gym? If not, your gym is violating the law. The Massachusetts Office of Consumer Affairs and Business Regulation recently inspected 15 local health clubs and found none were displaying fees or informing consumers of their right to cancel within three days, according to WBZ-TV. The office is referring the results to the state Attorney General’s office.

Health clubs cannot ask a member to sign a waiver of liability but, surprisingly, many still do. While waivers of liability, also known as releases, are generally enforceable in Massachusetts, G.L. c. 93, Sec. 80 specifically states, “No contract for health club services may contain any provisions whereby the buyer agrees not to assert against the seller or any assignee or transferee of the health club services contract any claim or defense arising out of the health club services contract or the buyer’s activities at the health club.”

This means gyms have a duty to properly maintain their premises and equipment and make sure they are being used in a safe manner, according to the manufacturer’s guidelines. If they do not, and they were negligent, they may be responsible for your damages. If you have been injured in a Massachusetts gym, the court should find the liability waiver void. Over the years, our injury lawyers have successfully challenged these agreements.

Gyms also cannot ask members to sign up for terms longer than 36 months or require that members agree to financing that lasts longer than one month beyond the membership period. Members cannot be required to agree to monthly automatic withdrawals from a bank account.

If you are joining a gym, the best thing you can do is read the fine print on your member agreement before signing. Research the organization online through your local Better Business Bureau website.

Consumer remedies for health club violations are limited. No health club will be permitted by the courts to enforce an illegal contract. A consumer may bring claims under the Massachusetts Consumer Protection Act, G.L. c. 93A, but damages will usually be nominal, although attorneys’ fees would be available.

Recent Court Ruling

The possibility of class actions was virtually eliminated by the recent ruling by the Supreme Judicial Court in Tyler v. Michaels Stores, Inc., 464 Mass. 492 (2013). An invasion of a consumer’s rights may be a violation of G.L. c. 93A, but unless the consumer has suffered a separate, identifiable harm arising from the violation, there will be no remedy. This case put a disappointing crimp into collective consumer action to prevent violations of the Consumer Protection Act, leaving overworked state officials to take up the slack.

Turn Your Clocks Back and Check Smoke Alarms, Carbon Monoxide Detectors

Nov. 4 is when we turn back the clocks, the usual sad good-bye to another summer and fall. At Breakstone, White & Gluck, we suggest taking a few of the extra minutes you gained to replace the batteries in your home’s smoke alarms and carbon monoxide detectors. Check whether the devices are working properly and replace them if needed.

Nov. 4 is when we turn back the clocks, the usual sad good-bye to another summer and fall. At Breakstone, White & Gluck, we suggest taking a few of the extra minutes you gained to replace the batteries in your home’s smoke alarms and carbon monoxide detectors. Check whether the devices are working properly and replace them if needed.

Smoke Alarms

Massachusetts requires a smoke alarm be installed on every habitable level of a residence as well as on the basement floor. The law requires two types of smoke alarms: photoelectric and ionization. Only photoelectric smoke detectors are to be installed within 20 feet of kitchens and bathrooms with showers. Ionization alarms are more sensitive and more likely to be disabled in these areas. Outside the 20-foot zone, both photoelectric and ionization alarms are required.

Carbon Monoxide Detectors

Carbon monoxide is a colorless, odorless, tasteless gas which can emerge without any warning. In a home, it could be caused by a gas leak in a furnace or other appliance. Early symptoms may include headache and dizziness, though inhalation can quickly lead to serious injuries, seizures, comas and death.

In Massachusetts, residences are required to have working carbon monoxide alarms on every habitable level of the home or dwelling unit. You can purchase an individual carbon monoxide detector or a dual smoke alarm and carbon monoxide detector.

If you have questions, your local fire department is a good resource for information, along with the manufacturer of your devices.

Read More

Homeowners Insurance Tips After Hurricane Sandy

In the aftermath of Hurricane Sandy, many people are assessing damage to their homes, cars and property. Insurance losses across the country are already estimated at $7 billion to $15 billion, while total losses will easily exceed $50 billion. If you are affected, it is important to act promptly. If you made it through the storm with property intact, now is a good time to plan for future hurricanes.

In the aftermath of Hurricane Sandy, many people are assessing damage to their homes, cars and property. Insurance losses across the country are already estimated at $7 billion to $15 billion, while total losses will easily exceed $50 billion. If you are affected, it is important to act promptly. If you made it through the storm with property intact, now is a good time to plan for future hurricanes.

The lawyers at Breakstone, White & Gluck offer these tips:

Contact your insurance company. If you suffered damage, immediately contact your insurance company. Call your agent, or call the company directly. Let them know what damage you suffered, and ask them to send claims forms. If the damage is extensive, you may find it useful to hire a public adjuster to catalog and estimate your damages.

File the claim. Obtain as much supporting information as you can, such as receipts and photographs if you have one. If you did an inventory of your home, that will be useful proof.

Cooperate with the adjusters. A field adjuster will visit your property to assess the damage to your home or your vehicles. Provide any additional information they need.

Understand your insurance policy.Nobody likes reading insurance policies (well, we know a few lawyers who enjoy that, but nobody else), but the policy will spell out the steps you must take during the claims process. Follow those steps to protect your rights in the event of a dispute of the money you are owed. Failure to cooperate or to follow claims procedures may lead to a denial of your claim.

Tree damage may be covered. Standard homeowners insurance policies cover damage if a tree falls on your home or a garage, shed or fence on your property. If it hits a neighbor’s property, then their policy or yours may cover it. If it just lands in your yard, it is likely that you will have to bear the entire cost of its removal.

Beware of Short Statute of Limitations. Contract claims in Massachusetts generally have a six-year statute of limitations. But it is likely that your insurance policy has provisions governing disputes that are much shorter, often just months after the insurance company makes its tender of settlement. If there is a dispute, get legal help quickly!

Make Sure You Are Protected for the Next Big Storm

Inventory your property. Filing a claim is easier if you know what you own and have documented it, including writing a list and taking pictures or a video. Keep a back-up copy of everything in a safe place away from the house. For help, the Insurance Information Institute has online software you can find at www.knowyourstuff.org.

Understand your policy. Have your agent or broker explain key provisions, exclusions, and other options. For liability insurance, consider adding an umbrella. For property damage, consider earthquake insurance.

Know your insurance policy’s hurricane deductible. Massachusetts is one of 18 states which allows homeowners insurance companies to set a specific deductible for hurricane damage.

Consider flood insurance. Flood-related losses are only covered if you have flood insurance. Standard homeowners and renter policies cover damage from wind and wind-driven rain that enters a home. But damage from water on the ground or seeping into a basement is not covered. This will be the main reason many victims of Hurricane Sandy will not have insurance coverage.

In fact, only about 20 percent of homeowners who should have flood insurance actually have the coverage, according to the Insurance Information Institute. Meanwhile the average residential flood results in $30,000 in damage, according to the National Flood Insurance Program. Consumers can learn more at www.floodsmart.gov.

Car Insurance. If you have a comprehensive auto insurance policy, flood damage to your car should be covered. But motorists carrying only liability coverage will not be covered.

Please explore some of our other articles on insurance basics. The policies you have protect you from claims, cover your property losses, and in many cases pay you for damages caused by others who may be underinsured. Usually it is worth the extra cost to have that peace of mind.

Understanding and Buying Massachusetts Car Accident Insurance

What Every Massachusetts Bicyclist Needs to Know About Car Insurance

Read More